extended child tax credit 2022

Before COVID-19 the child tax credit was worth 2000 per child. 2022 Child Tax Credit.

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

But without intervention from Congress the program will instead revert back to its original form in 2022 which is less generous.

. The child tax credit which offers financial assistance to parents was expanded last year in the White Houses pandemic relief legislation allowing most US. SHARE Experts wrangle over impact of now-defunct expanded child tax credit. That means that when parents claim the tax credit on their returns next year the benefit will be reduced to the previous.

Not only that it would have modified it to. That meant if a household claiming the credit owed the IRS no money it. There are several key differences between the expanded child tax credit parents enjoyed last year and the pared-back one that theyre settling for in 2022.

For 2022 the tax credit returns to its previous form. As such there was. How Expansion Could Eliminate Poverty for Millions.

This means the child tax credit has returned to what it was before COVID-19 hit. According to the Tax Policy Center the price of reverting to the old child tax credit for 2022 would be about 1255 billion whereas the more generous benefit of 2021 which. Families are making awful.

The American Rescue Plan Act ARPA expanded the Child Tax Credit CTC program in 2021 in response to pandemic-related. First its worth only. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan.

The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments. 2 days agoPrices are soaring and employment among those receiving monthly child tax credit payments declined by 41 after the monthly credit expired. Families could qualify for up to 3000 per child between ages 6 and 17 and 3600 per child under 6 and receive half of the sum before actually filing their taxes.

Child Tax Credit Dependent Care Program Changes for 2022. In this April 23 2020 photo President. Apr 20 2022 500pm PDT.

Half of these funds have already been allocated to qualifying households in the previous year. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US. This expanded child credit is in effect for 2021 and 2022 and it expires at the end of 2025.

The child tax credit which offers financial assistance to parents was expanded last year in the White Houses pandemic relief legislation. 1 day agoBy reinstating the expanded and monthly child tax credit which expired earlier this year 92 of all children in Arizona would benefit and millions of families would see immediate. New research shows a permanently expanded child tax credit could bring benefits 10 times greater.

President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022. Last March Congress added a second expansion of the credit just for 2021 as part of. This credit is also not being paid in advance as it was in 2021.

A 2000 credit per dependent under age 17. Government disbursed more than 15 billion of monthly child tax credit payments in July. May 27 2022 at 338 pm.

This means that the credit will revert to the previous amounts of 2000 per child. The 2022 Expanded Child Tax credit is due to deliver even more money to American families. Prior to 2021 the Child Tax Credit maxed out at 2000 per child and was only partially refundable.

Here is what you need to know about the future of the child tax credit in 2022.

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Reasons To Go Solar Energysage Solar Energy Panels Solar Energy Diy Solar Technology

Child Tax Credit 2022 Update Millions Of Americans Can Claim 2 000 Per Child Find Out Your Maximum Amount

Child Tax Credit 2022 Update Millions Of Americans Can Claim 2 000 Per Child Find Out Your Maximum Amount

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax

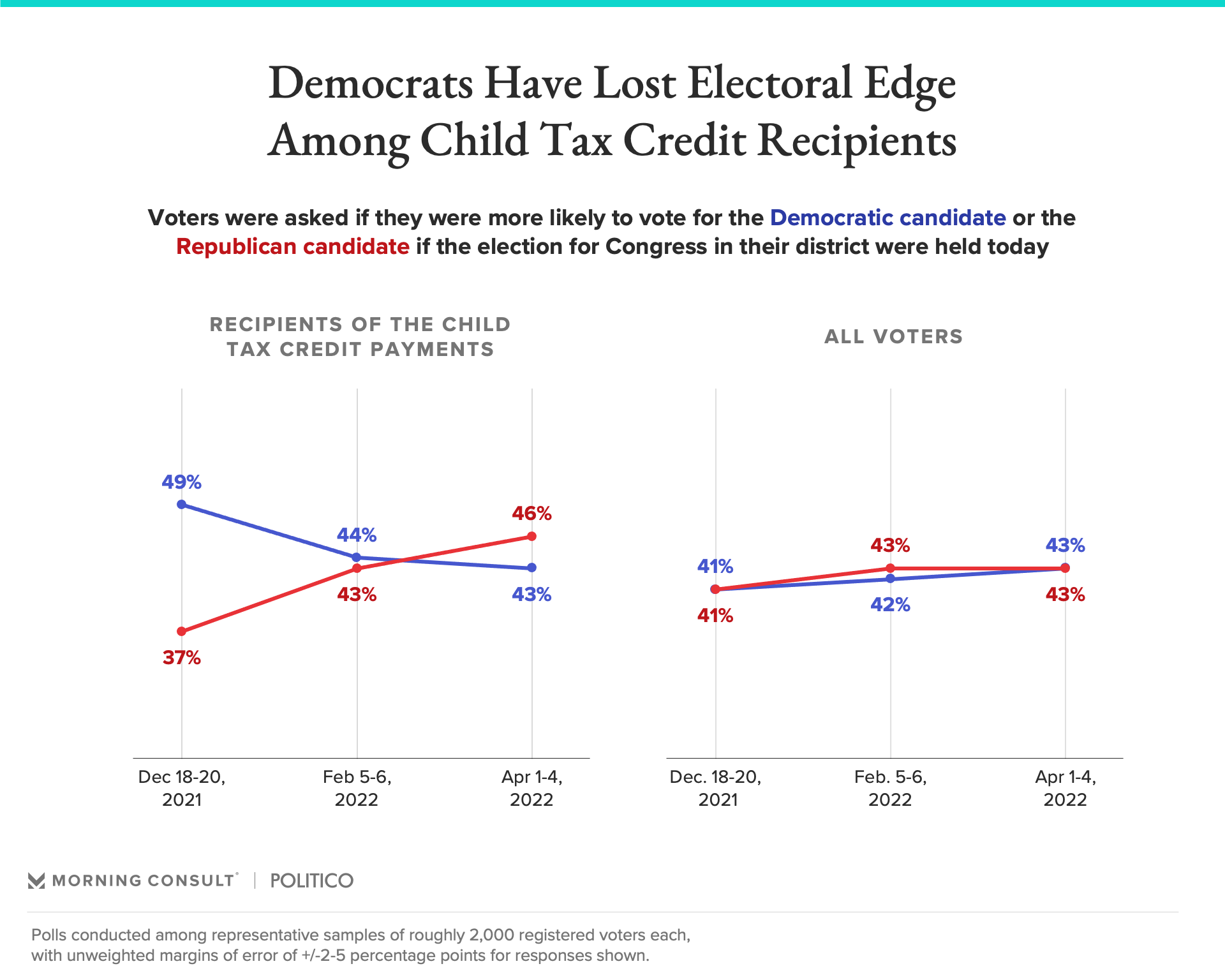

Republicans Favored To Win Senate Among Child Tax Credit Recipients

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

No More Monthly Child Tax Credits Now What

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Federal Solar Tax Credit Extended Residential Solar Tax Credits Solar